Saving for your child’s higher education can feel overwhelming, especially when tuition costs continue to rise. But there’s good news: planning ahead with a NEST 529 Education Savings Plan gives you the tools and flexibility to set your future graduate up for success. Plus, NEST 529 funds can be used for most public and private universities, community colleges, graduate schools, trade schools, and event apprenticeships — so no matter where your loved one wants to go, you’ll be prepared to support them. The question is, how much should you be saving?

Make Saving Easy

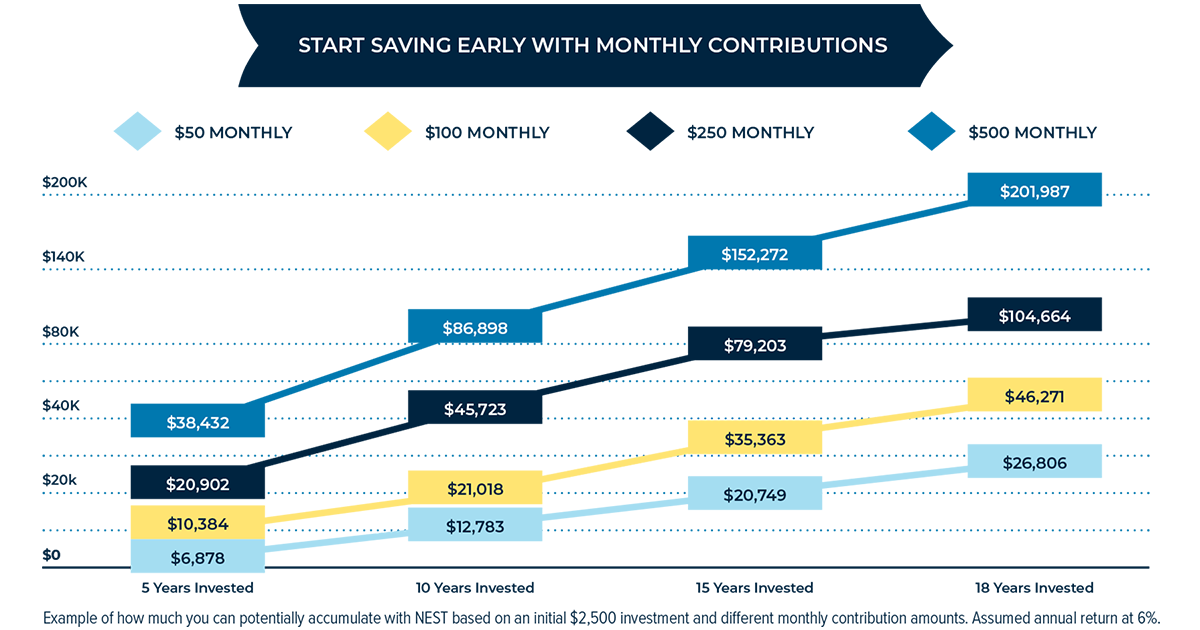

With NEST 529, even small contributions can make a big difference over time. When you add $50 a month to your account, that's around $1.60 a day. Those contributions act as an investment that can potentially grow over time, helping you save even more.

Use the NEST College Savings Estimator to find a savings plan that works for your family. This step-by-step calculator helps you estimate how much you’ll need to contribute to cover future education expenses.

NEST 529 offers a variety of tools and resources to make saving simple and stress-free:

- Educational Videos: Check out the “How Much Should You Save for College?” Ask Penny video to get practical advice on saving smarter.

- Activity Sheet: Encourage your kids to start thinking about financial literacy early by downloading this fun, printable activity here.

- Automated Investing: Set up a plan to contribute funds monthly, quarterly, or annually. Automating your savings helps you stay on track without the hassle of manual payments.

The Rising Costs of Higher Education

|

When NEST 529 launched in Nebraska more than 20 years ago, the cost of higher education looked very different. Today, tuition is just one part of the equation. Living expenses, fees, and books often add up to more than scholarships and grants can cover. According to College Board1, here was the average annual cost of tuition and fees for full-time higher education students in 2024-25:

- Public, two-year institution: $4,050

- Public, four-year, in-state institution: $11,610

- Public, four-year, out-of-state institution: $30,780

- Private, nonprofit, four-year institution: $43,350

1College Board. Trends in Higher Education Series: Trends in College Pricing and Student Aid 2024. https://research.collegeboard.org/media/pdf/Trends-in-College-Pricing-and-Student-Aid-2024-ADA.pdf

Higher education is one of those things that’s easy to “put off” planning for until your kids are older. But since higher education costs are rising faster than the inflation rate, it’s important to plan ahead as early as you can — and it may be easier than you think.

|

There’s no one-size-fits-all answer to how much you should save for higher education. The key is to start now and commit to a plan that fits your budget. Every dollar you save today is one less dollar your child may need to borrow tomorrow. By investing in a NEST 529 plan, you’re giving your child the opportunity to soar toward their dreams.

Want to learn more? Visit NEST529.com.

###

Important Legal Information

An investor should consider the investment objectives, risks, and charges and expenses associated with municipal fund securities before investing. This and other important information is contained in the fund prospectuses and the NEST Direct College Savings Plan Program Disclosure Statement (issuer’s official statement), which can be obtained at NEST529.com and should be read carefully before investing. You can lose money by investing in an Investment Option. Each of the Investment Options involves investment risks, which are described in the Program Disclosure Statement.

An investor should consider, before investing, whether the investor’s or beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in such state’s 529 plan. Investors should consult their tax advisor, attorney, and/or other advisor regarding their specific legal, investment, or tax situation.

The NEST Direct College Savings Plan (the “Plan”) is sponsored by the State of Nebraska, administered by the Nebraska State Treasurer, and the Nebraska Investment Council provides investment oversight. Union Bank and Trust Company serves as Program Manager for the Plan. The Plan offers a series of Investment Options within the Nebraska Educational Savings Plan Trust (the “Trust”), which offers other Investment Options not affiliated with the Plan. The Plan is intended to operate as a qualified tuition program.

Except for any investments made by a Plan participant in the Bank Savings Underlying Investment up to the limit provided by Federal Deposit Insurance Corporation (“FDIC”) insurance, neither the principal contributed to an account, nor earnings thereon, are guaranteed or insured by the State of Nebraska, the Nebraska State Treasurer, the Nebraska Investment Council, the Trust, the Plan, any other state, any agency or instrumentality thereof, Union Bank and Trust Company, the FDIC, or any other entity. Investment returns are not guaranteed. Account owners in the Plan assume all investment risk, including the potential loss of principal.

NOT FDIC INSURED*| NO BANK GUARANTEE | MAY LOSE VALUE

(*Except the Bank Savings Underlying Investment)